Understanding Forex Charts: A Crucial Skill for Traders

Analyzing forex charts is an indispensable skill for traders looking to make informed decisions in the forex market. One of the primary elements of chart analysis involves understanding various types of charts, including line, bar, and candlestick charts. Each of these chart types presents price movements differently, providing unique insights into market conditions.

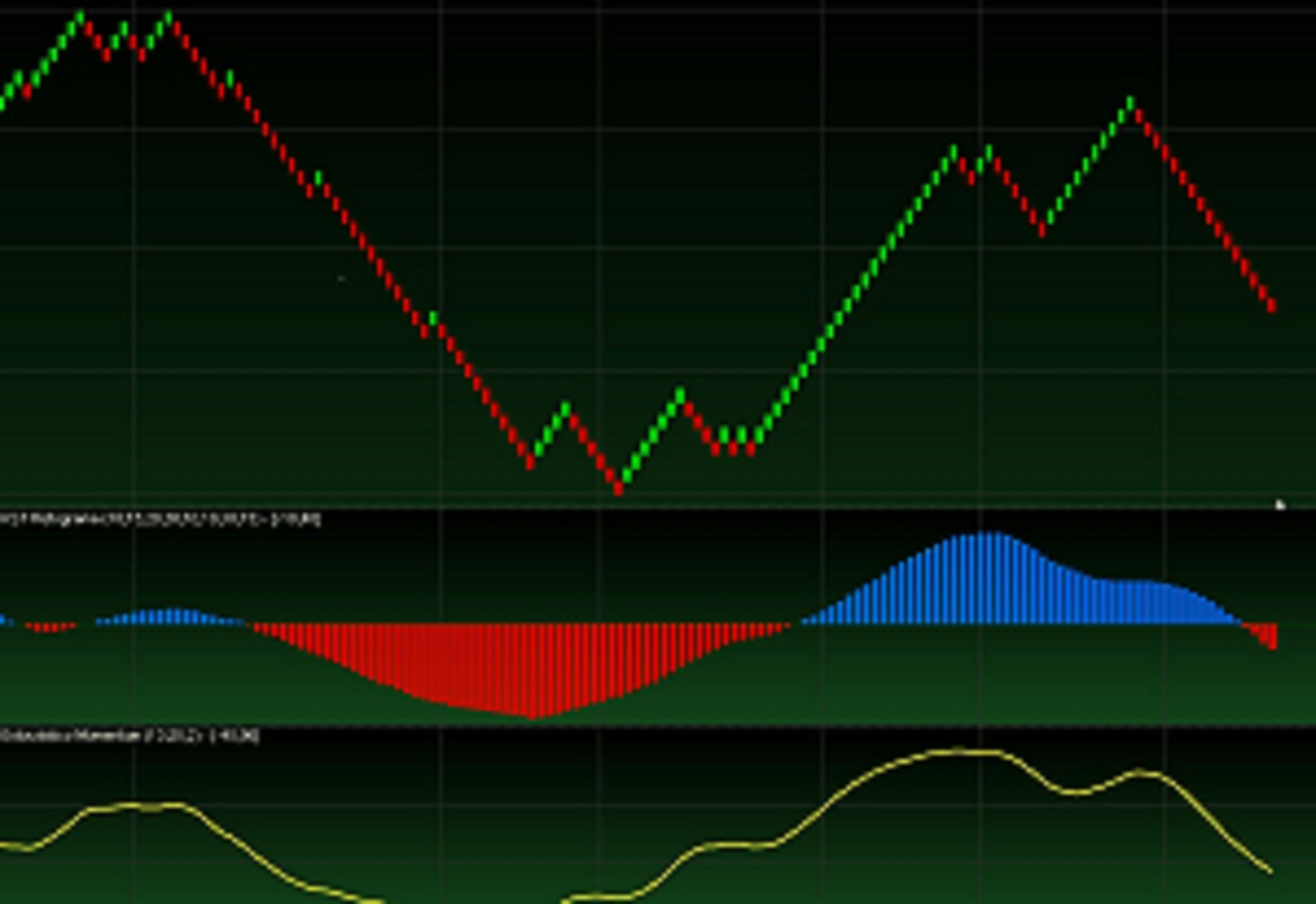

Candlestick charts, for instance, are particularly popular among traders due to their ability to convey a wealth of information in a compact format. Each candlestick represents a specific time period, showcasing the opening, closing, high, and low prices. The patterns formed by these candlesticks can signify potential market reversals or continuations, making them a vital tool in technical analysis.

Besides recognizing candlestick patterns, traders must also pay attention to support and resistance levels. Support refers to a price level where buying interest tends to outweigh selling pressure, whereas resistance indicates where selling interest exceeds buying. Identifying these levels helps traders understand potential entry and exit points, aiding in effective risk management.

Trend identification is another key aspect of analyzing forex charts. Recognizing whether the market is in an upward, downward, or sideways trend enables traders to align their strategies accordingly. Tools such as trend lines and moving averages can assist in visualizing current market trends, further guiding strategic decisions.

Technical analysis is complemented by the use of indicators and oscillators. Popular tools such as the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and Bollinger Bands provide traders with additional insight into market momentum and potential reversal points. By integrating these tools with chart analysis, traders can cultivate a comprehensive understanding of market behavior, significantly enhancing their trading strategies.

Fibonacci Trading: Harnessing Retracements for Success

The Fibonacci retracement tool is a pivotal component in the arsenal of both forex and cryptocurrency traders. This technique roots itself in the Fibonacci sequence, a mathematical series where each number is the sum of the two preceding ones. By applying this concept to trading, investors can identify potential reversal points within financial markets. These crucial levels are derived by plotting horizontal lines at key Fibonacci levels, typically at 23.6%, 38.2%, 50%, 61.8%, and 100% of a given price range. Understanding how to draw and interpret these levels accurately on charts is fundamental for effective trading.

To draw Fibonacci levels, traders typically select a significant recent price move, marking the swing high and swing low. The tool then automatically generates retracement lines based on the selected price range. This process not only assists traders in visualizing market support and resistance levels but also highlights areas where price reversals may occur. Consequently, it helps in formulating entry and exit strategies. Fibonacci levels work best when combined with other technical indicators, such as moving averages or trend lines, to substantiate trading decisions. For instance, if a trader observes that a price level coincides with both a Fibonacci retracement level and a moving average, this confluence can yield a stronger signal for a potential trade.

Moreover, implementing risk management strategies alongside Fibonacci trading is essential for safeguarding investments. By setting stop-loss orders just beyond key Fibonacci levels, traders can minimize their risks if the market does not behave as anticipated. Overall, mastering the Fibonacci retracement tool equips traders with a valuable approach to navigate the complexities of the forex and crypto markets, enhancing their ability to make informed decisions and manage risks effectively.

Crypto Trading Tips: Navigating the Volatile Market

Navigating the unpredictable world of cryptocurrency trading requires not only strategic foresight but also a robust understanding of various market dynamics. One of the critical foundations for success in crypto trading is effective risk management. Traders must allocate only a small portion of their total capital to each trade, ideally no more than 1-2% of their portfolio. This practice safeguards against significant losses while allowing for sufficient exposure to market upside potential.

Another essential aspect of crypto trading is market analysis. Engaging in both fundamental and technical analysis can substantially enhance a trader’s decision-making process. Fundamental analysis entails a thorough examination of news, technological advancements, and macroeconomic factors that may influence cryptocurrency value. Staying informed about regulatory changes or market sentiment shifts can prove invaluable. Conversely, technical analysis focuses on historical price movements and charts to identify trends and patterns. Utilizing tools such as moving averages, RSI (Relative Strength Index), and Fibonacci retracement can provide clearer insights for future price action.

Understanding market cycles is equally significant in trading strategies. Cryptocurrencies are notorious for their volatile nature, and recognizing the different phases of market cycles—from accumulation to distribution—can inform better entry and exit points. Traders should also take into account the psychological components of trading, as emotions can heavily sway decision-making. Maintaining discipline and adhering to a predefined trading plan can help mitigate impulsive choices influenced by fear or greed.

Lastly, being responsive to news and events is crucial. The crypto market is uniquely sensitive to announcements, such as partnerships, technology upgrades, or regulatory discussions. Therefore, keeping abreast of the latest developments can provide a significant edge. By merging effective risk management, a thorough understanding of market analysis, and an awareness of psychological factors, traders can navigate the volatile landscape of cryptocurrency with greater confidence and success.

Exploring Forex Spread and Trading Systems

The forex spread is a critical concept in foreign exchange trading, representing the difference between the bid and ask prices of a currency pair. This spread is a primary cost associated with trading, as it effectively determines how much a trader pays to enter and exit positions. Understanding the significance of forex spreads is essential for traders to calculate potential profitability accurately and make informed trading decisions. They can significantly impact overall trading costs, particularly for frequent traders.

Forex spreads can be categorized into two main types: fixed spreads and variable spreads. Fixed spreads remain constant regardless of market conditions, providing traders with predictable costs. This type can be advantageous in volatile market situations, offering stability. However, fixed spreads may be higher compared to their variable counterparts, especially during times of low volatility when the market is more stable.

On the other hand, variable spreads fluctuate based on the market’s liquidity and volatility. When market activity is high, variable spreads may narrow, leading to lower trading costs for traders. Conversely, in periods of low liquidity, these spreads can widen, increasing trading expenses. It is crucial for traders to weigh the advantages and disadvantages of both spread types, as well as their individual trading strategies, to determine which spread aligns best with their goals.

In addition to understanding spreads, traders often utilize various trading systems to optimize their performance. Day trading, for instance, involves executing multiple trades within a single day, focusing on short-term price fluctuations. Swing trading, conversely, aims to capture more significant price movements over several days or weeks. Position trading is a longer-term strategy, where trades are held for an extended period based on fundamental analysis. The selection of a trading system should reflect a trader’s risk tolerance, experience, and capital availability to maximize success in forex trading.