Understanding Elliott Wave Theory

Elliott Wave Theory, developed by Ralph Nelson Elliott in the 1930s, is a market analysis philosophy positing that financial markets move in repetitive cycles, reflecting the emotions and psychology of market participants. At its core, Elliott Wave Theory asserts that stock price movements can be broken down into distinct patterns called waves, which are indicative of market sentiment shifts. This framework empowers traders to identify potential market reversals and continuations through the analysis of these wave structures.

The foundation of Elliott Wave Theory revolves around the concept that each market movement has a specific pattern comprised of five waves in the direction of the trend and three corrective waves against it. The five-wave pattern is often labeled as waves one through five, while the corrective waves are typically referred to as waves A, B, and C. This wave structure operates on various degrees, ranging from smaller intraday movements to larger multi-year cycles. Understanding these degrees is essential for traders looking to place trades aligned with broader market trends.

Moreover, the psychology behind market movements is pivotal within Elliott Wave Theory. As traders collectively react to news, economic indicators, and geopolitical events, the waves formed signify their emotional responses—optimism during upward trends and pessimism during downward trends. Analyzing these waves allows traders to forecast potential market corrections or continuations, providing them with actionable trading opportunities. For example, if a trader recognizes a completed five-wave sequence, they may anticipate a corrective wave, thus enabling them to strategically enter or exit positions accordingly.

By mastering the principles of Elliott Wave Theory, traders can enhance their analytical skills, allowing them to analyze stock price action more effectively. This understanding fosters informed decision-making and can significantly improve trading outcomes. Ultimately, incorporating Elliott Wave Theory into a trading strategy can lead to greater insight into market dynamics and trader behavior.

Utilizing Stock Screeners for Trading Success

Stock screeners are essential tools in the trading community that enable investors to identify viable trading opportunities by filtering and sorting available stocks based on specific criteria. A stock screener essentially helps traders sift through a multitude of stocks to pinpoint those that meet their unique trading parameters, thereby enhancing decision-making and enabling a more focused approach to market participation. By utilizing market capitalization, trading volume, price movements, and various technical indicators, traders can conveniently narrow their search to find stocks that align with their trading strategies.

Setting up a stock screener involves selecting filters that resonate with an individual trader’s criteria. For instance, a trader might focus on stocks with a market capitalization greater than $1 billion to filter out smaller, potentially riskier investments. Volume filters are also crucial; selecting stocks with a high average daily volume can ensure that the stocks are liquid enough for buying and selling without significantly impacting the price. Price movement indicators, such as percentage gains or losses over a specific time frame, can also help traders identify stocks that are gaining momentum or experiencing volatility, which can present both opportunities and risks.

Moreover, traders can customize their screeners by incorporating additional indicators that are relevant to their strategies, such as earnings per share (EPS), dividend yield, or P/E ratios. Depending on their trading styles—be it day trading, swing trading, or long-term investing—these adjustments can provide a tailored setup that increases the chances of identifying promising stocks. By regularly adjusting the filters based on market conditions and personal investment objectives, traders can maintain a dynamic approach to utilizing stock screeners effectively. In summary, mastering the functions of stock screeners can significantly enhance a trader’s ability to find and capitalize on profitable trading opportunities in an ever-evolving marketplace.

Incorporating Indicators into Your Trading Strategy

Utilizing technical indicators is a vital component of successful trading strategies. Among the most widely used indicators are moving averages, the Relative Strength Index (RSI), the Moving Average Convergence Divergence (MACD), and Bollinger Bands. Each of these tools serves a particular purpose and provides traders with valuable insights into market behavior, making it crucial to understand their functionalities and implications.

Moving averages help smooth price action and identify trends over a specific period. By comparing short-term and long-term averages, traders can ascertain potential entry and exit points based on crossovers. For instance, when a short-term moving average crosses above a long-term moving average, it could signal a buying opportunity. On the other hand, if it crosses below, traders might interpret it as a sell signal.

The Relative Strength Index (RSI) measures the speed and change of price movements, indicating whether a security is overbought or oversold. It ranges from 0 to 100, with values above 70 indicating overbought conditions and those below 30 suggesting oversold conditions. Utilizing the RSI can assist traders in identifying reversal points or confirming the strength of a trend.

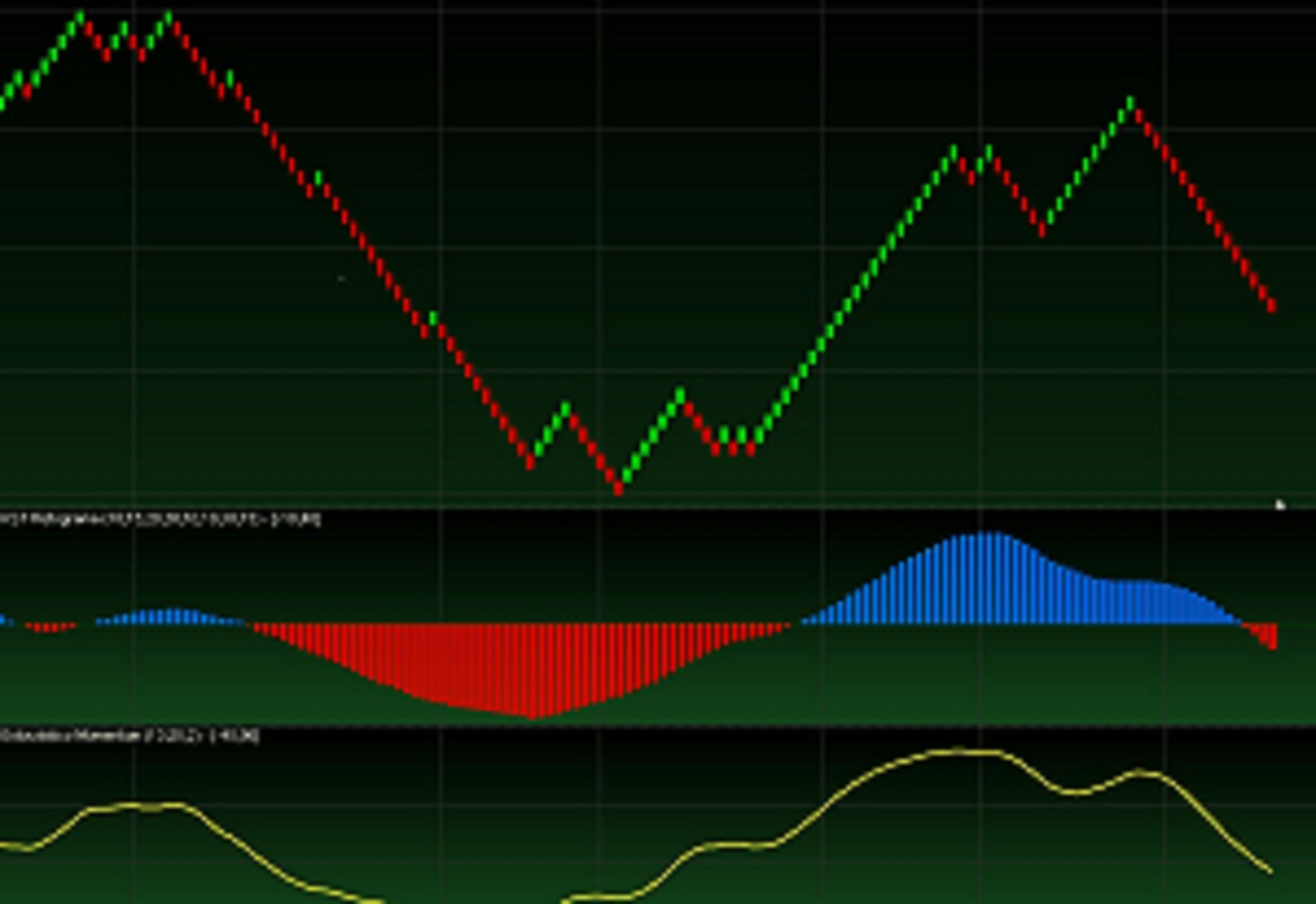

MACD is another essential indicator that highlights the relationship between two moving averages of a security’s price. It generates signals through crossovers, divergences, and the histogram, which helps traders gauge momentum. Lastly, Bollinger Bands offer insights into market volatility, comprising a middle band (the moving average) and two outer bands that reflect standard deviations. Price movements touching or breaching these bands can indicate potential buy or sell signals.

It is prudent to integrate multiple indicators to enhance the robustness of a trading strategy. However, traders should exercise caution against over-reliance on any single tool. Instead, they should aim for a balanced approach, analyzing signals from various indicators together to make informed, data-driven trading decisions. This strategy not only enhances reliability but also reduces the impact of false signals, ultimately leading to a more consistent trading practice.

Forex Trading: Signals and Trend Indicators

Forex trading, a dynamic and ever-evolving landscape, relies heavily on the interpretation of price movements and trends within currency pairs. For traders aiming to optimize their strategies, understanding live signals and trend indicators is crucial. Live signals essentially serve as alerts, providing real-time information on market movements, and help traders identify potential entry and exit points. Recognizing the patterns and signals associated with various currency pairs allows traders to make informed decisions, enhancing their chances for profitability.

Trend analysis is an essential component of forex trading, enabling traders to determine the general direction of the market. By analyzing price patterns, traders can identify bullish or bearish trends, which assists in crafting effective trading strategies. Trend indicators, such as the Moving Average, Relative Strength Index (RSI), and Bollinger Bands, are invaluable tools that simplify this analysis. Each of these indicators offers unique insights: Moving Averages smooth out price fluctuations, RSI indicates overbought or oversold conditions, while Bollinger Bands signify volatility. Utilizing these indicators can empower traders to interpret the market’s behavior more effectively.

To enhance trading decisions, it is critical to evaluate the reliability of live trading signals and trend indicators. Numerous platforms provide these tools, but not all are created equal. Traders must assess the accuracy, reputation, and performance history of the systems they consider employing. Furthermore, combining multiple indicators can lead to a robust trading strategy, as relying on just one signal may yield misleading outcomes. Therefore, mastering these tools is essential not just for recognizing current trends but also for anticipating future movements. With the right approach and resources, traders can harness the power of forex trading signals and trend indicators, paving the way for successful trading outcomes.