Understanding Price Action in Forex Trading

Price action trading is an essential concept within the forex market, focusing on the analysis of historical price movements to inform trading decisions. Rather than relying on technical indicators or fundamental analyses, traders who adopt this approach prioritize the interpretation of price patterns and trends. A fundamental aspect of price action trading is recognizing significant price movements and understanding their implications for future trends.

Key to mastering price action is the identification of support and resistance levels. Support refers to a price level where buying interest is strong enough to prevent the price from declining further, while resistance indicates a level where selling pressure is sufficient to halt upward movement. By analyzing these levels, traders can identify potential entry and exit points, enhancing their chances of successful trades. This understanding allows for more disciplined risk management and trading strategy formulation.

The role of market psychology is also integral to price action trading. Market participants’ emotions, such as fear and greed, can lead to price movements that reflect collective decision-making rather than mere data interpretations. Observing how prices react to specific events or news releases can provide valuable insights into market sentiment. For instance, sharp price reversals may suggest a shift in trader sentiment, which can be harnessed for future trades.

To implement price action strategies effectively, traders are advised to practice analyzing historical charts with various time frames, searching for recurring patterns and behaviors. Additionally, it’s beneficial to maintain a trading journal to document observations and outcomes, honing the ability to read price movements. While price action trading offers a straightforward approach, developing proficiency in its application requires patience and continuous learning.

Incorporating Indicators in Forex Trading

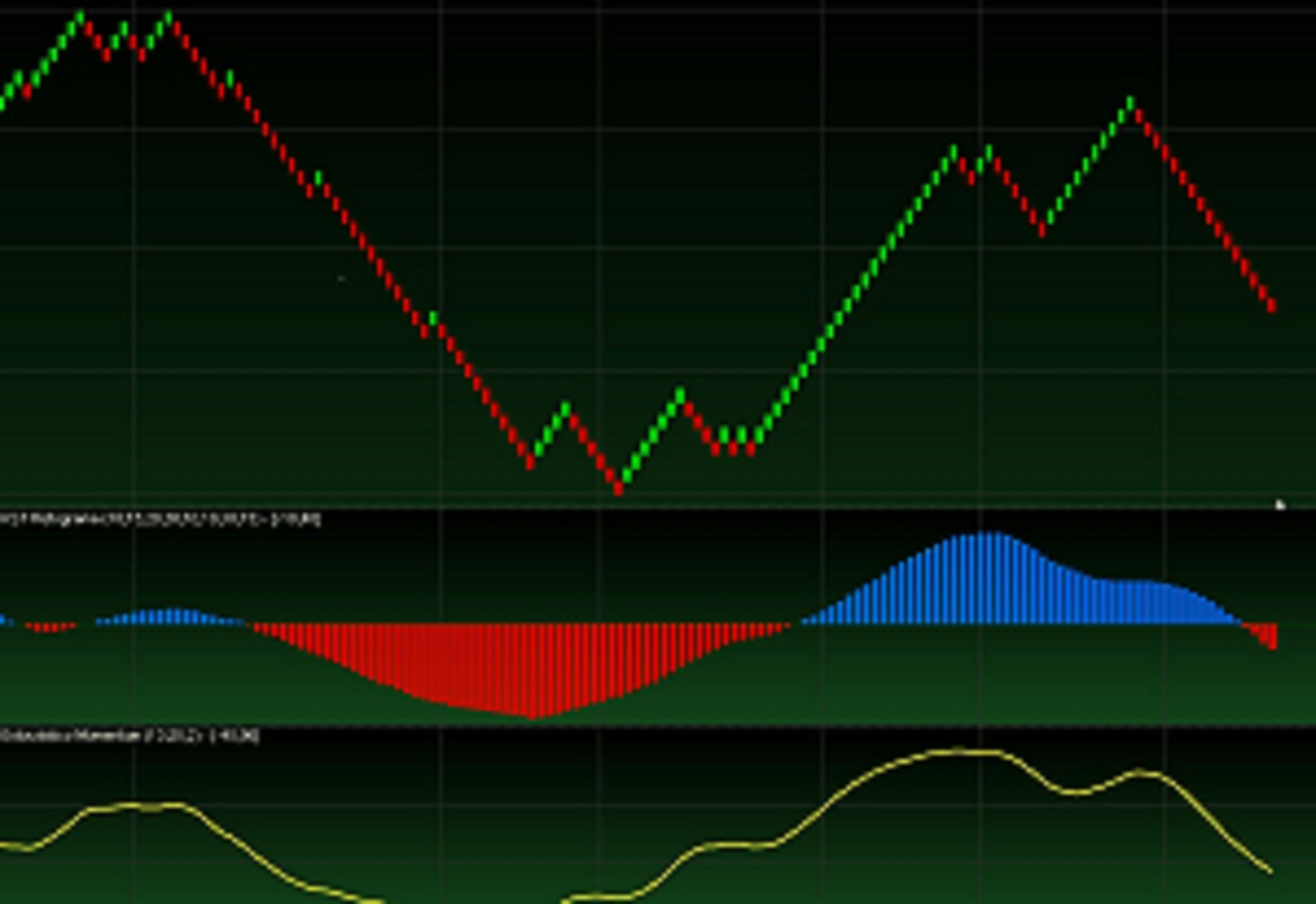

Technical indicators serve as vital tools for forex traders, offering insights into market trends and potential price movements. Among the most commonly utilized indicators, moving averages, the Relative Strength Index (RSI), and the Moving Average Convergence Divergence (MACD) stand out for their effectiveness in various market conditions. Each of these indicators provides distinct advantages and can be formulated into a trader’s strategy to enhance decision-making.

Moving averages, which smooth out price data over a specified period, help traders identify trends and potential reversal points. By analyzing the crossover of short-term and long-term moving averages, traders can signal when to enter or exit positions. This technique is particularly beneficial during volatile market conditions, as it reduces the noise and enables a clearer view of market direction.

Similarly, the Relative Strength Index (RSI) is a momentum oscillator that indicates whether a currency pair is overbought or oversold. By evaluating the momentum of price movements, the RSI aids traders in identifying potential reversals. An RSI reading above 70 typically suggests an overbought condition, while a reading below 30 indicates an oversold state. Integrating RSI analysis with other indicators can provide a more comprehensive understanding of market sentiment.

The MACD, on the other hand, combines the aspects of trend-following and momentum by showing the relationship between two moving averages of a currency pair’s price. It provides signals through its histogram and crossover points, aiding traders in determining momentum shifts. However, while these indicators significantly enhance trading strategies, traders must remember that they should not rely solely on them. A well-rounded trading plan incorporates a combination of indicators with sound risk management, market analysis, and emotional discipline, ensuring a more holistic approach to forex trading.

Developing a Forex Trading Strategy

Crafting a personalized forex trading strategy is an essential step for anyone looking to navigate the complexities of the foreign exchange market. A well-defined strategy provides a roadmap that aligns your trading objectives with your overall financial goals. The first key component to consider is setting clear objectives. Determine what you want to achieve through forex trading—whether it’s generating supplemental income, saving for retirement, or simply engaging in a rewarding hobby. Clear objectives will guide your decision-making process and help you maintain focus amidst market volatility.

Another crucial element involves risk management. Understanding your risk tolerance is vital in forex trading, as the market can experience significant fluctuations. You should explicitly define the amount of capital you are willing to risk in each trade. Utilization of stop-loss orders is advisable, allowing traders to limit potential losses effectively. A solid risk management strategy will help protect your investments and ensure you can continue trading over the long term.

Additionally, employing a trading plan template can enhance your effectiveness in the forex market. This template should include specific entry and exit points, along with the criteria for taking trades. Furthermore, incorporating technical analysis and market research will provide valuable insights into potential market movements. Continuous evaluation and adjustment of your strategy are critical—what works in one market environment may not be applicable in another.

For those seeking to refine their strategies, numerous resources are available that offer free forex strategies. Utilizing educational platforms and forex simulators can aid both beginners and experienced traders in testing and fine-tuning their approaches. By combining clear objectives, robust risk management, and strategic planning, traders can develop a forex trading strategy that is tailored to their personal and financial needs, ultimately increasing their chances of success in the forex market.

Common Forex Trading Mistakes and How to Avoid Them

Forex trading, while potentially lucrative, is fraught with pitfalls that can lead to significant losses. One of the most prevalent mistakes is emotional trading, where decisions are influenced by fear, greed, or anxiety. This often results in impulsive moves that deviate from a trader’s established strategy. To combat this, traders should practice disciplined decision-making and adhere strictly to their trading plans. Keeping a trading journal can also help in recognizing emotional patterns that lead to poor choices.

Another common mistake is the neglect of stop loss orders. Failing to set these protective orders can expose a trader to unlimited losses, particularly in the volatile forex market where price fluctuations can occur rapidly. It is crucial to determine an appropriate stop loss level for each trade, based on market volatility and individual risk tolerance. Educating oneself on how to effectively use stop loss orders can prove invaluable in managing risk and preserving capital.

Additionally, many traders enter the market without a clear trading plan. A robust trading plan should outline specific goals, entry and exit strategies, risk management protocols, and criteria for evaluating trade performances. Without such a plan, traders are likely to make arbitrary decisions that can lead to failure. Traders can enhance their strategies by utilizing daily forex signals for guidance, as these provide insights into market trends and potential trading opportunities. This approach can help traders align their actions with a strategic vision rather than relying on guesswork.

By being aware of these common mistakes and implementing preventive strategies, traders can improve their performance in the forex market. A disciplined approach, effective risk management techniques, and the use of reliable trading signals can significantly enhance a trader’s profitability while minimizing potential pitfalls.